Pinnacle are well known in the betting industry for being uniquely tolerant of arbitrage bettors, offering them the same limits as any other better and not restricting or closing accounts like other bookmakers. Why is Pinnacle arbitrage friendly? Read on to find out.

Pinnacle argue that they are able accept arbitrage bettors because their “risk-management is regarded as among the best online.” In practical terms they are consistently on the right side of the arbitrage. In this article I will look at some data to explore precisely what this means and why Pinnacle can consistently keep offering arbitrage opportunities whilst other bookmakers run scared.

What is arbitrage?

Put simply, arbitrage betting involves backing all sides in a contest with appropriately sized stakes to ensure that no matter what the outcome the bettor will secure a profit.

As a brief example, suppose Team A is priced a 2.10 and Team B at 1.95. Provided I bet the appropriate stakes (most easily calculated as the inverse of the decimal odds), I will make a return of 101.11% regardless of whether Team A or Team B wins. More generally, you can calculate your expected arbitrage return as the inverse of the sum of the arbitrage stakes.

For arbitrage opportunities to exist there must be sufficiently divergent opinion amongst bookmakers to make available prices whose implied win probabilities (with their margins included) sum to less than 100%. Clearly, it helps when bookmakers’ margins are small, meaning it will take less difference of opinion to create an arbitrage opportunity.

Since Pinnacle have such small margins compared to many other bookmakers, they offer some of the best prices available in a betting market, and hence feature commonly in arbitrage opportunities.

Arbitrage from the bookmaker’s perspective

From the bettor’s perspective it doesn’t really matter which of the odds is accurate since they are securing a guaranteed profit regardless. From the bookmaker’s perspective however, at least one price must be wrong, and this presents a liability.

Pinnacle make a point of offering accurate prices, or at least prices that do not stray away from ‘true’ values by more than their margin. Presumably, for them it’s the best pricing model with which to make a profit.

In the example above, let’s suppose the ‘true’ prices for Team A and Team B are 2.00, implying a 50% probability of winning for each. Typically, bookmakers with a 2.5% margin would publish odds of 1.95 for both teams, ensuring they have positive expectation on both sides.

Suppose instead a bookmaker takes a different view, fairly pricing Team A at 2.15 and Team B at 1.87. After adding his margin, his published prices will be around 2.10 and 1.82.

Now Team A holds negative expectation, from the perspective of the bookmaker. Hence to be able to offer prices that routinely appear within arbitrage opportunities it will be in the bookmaker’s interests to be able to accurately assess ‘true’ outcome probabilities. We can use data to find out whether Pinnacle is good at it.

Arbitrage opportunities in soccer match betting odds

Since 2001 I’ve been collecting betting odds to help bettors develop and test systems for soccer betting. These odds have included Pinnacle’s match betting odds as well as the best odds in the market available at the same time.

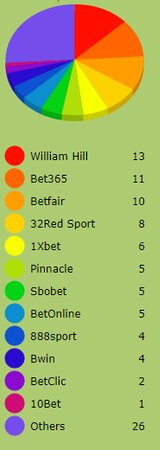

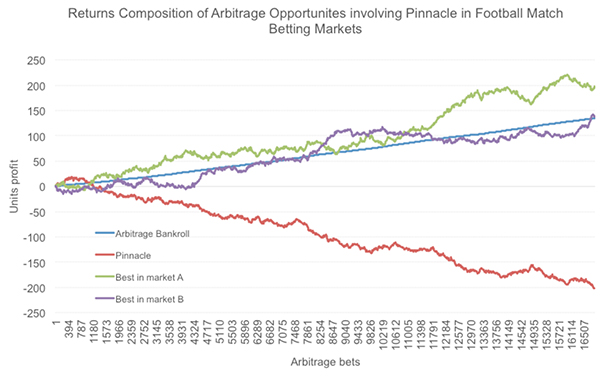

From a sample of 50,210 European soccer league matches playing between July 27, 2023 and March 5, 2019, I found 16,861 pre-market-closure opportunities where the sum of the implied home, draw and away probabilities was less than 100%, offering a theoretical arbitrage opportunity. With an average arbitrage return of 100.81% (or 0.81% profit), your theoretical bankroll would stand at €13,670 if you had bet €100 for every arbitrage.

Take a look at the chart below comparing how that profit would have accumulated. There are four time series: the overall bankroll growth, the returns from betting Pinnacle’s odds and the returns from betting the other two best-in-market options in a three-way soccer match bet.

It’s perfectly obvious that other bookmakers are contributing to the overall arbitrage returns whilst Pinnacle are consistently offering the negative expectation price, from the perspective of the bettor. The actual returns from the Pinnacle-only turnover were 95.5%, or a loss of 4.5%, compared to 102.7% for the other bookmakers making up the arbitrage.

Such a chart should provide further evidence, if it was needed that, that Pinnacle are routinely more accurate at pricing soccer match betting markets than other bookmakers.

This is not to argue that other bookmakers are not as good at assessing ‘true’ prices; there are indeed other explanations why they might choose to offer odds which are in effect loss leaders. One, for example, might be to attract new customers to apparent better value. Don’t forget, of course, that such bookmakers will almost certainly prevent you from exploiting such opportunities on a repeated basis.

Is Pinnacle exploiting arbitrage?

The Pinnacle return of 95.5% is considerably less than might be predicted by Pinnacle’s average margin for these 16,861 matches, which would imply a return of 97.6% or a loss of 2.4%.

The upside to their accurate odds is that they will always allow you to practice arbitrage, knowing that it’s the other bookmakers, not themselves, that will be taking the hit.

Might Pinnacle be intentionally increasing their margin on these arbitrage odds, knowing that arbitrage hunters won’t care, so long as the prices at other bookmakers are sufficiently generous to make the opportunities available? Furthermore, would that mean that Pinnacle’s other odds not forming part of the arbitrage offer any value?

The returns from Pinnacle’s other two odds in the soccer match bets were 98.3%, better than Pinnacle’s odds appearing in the arbitrages opportunities but not enough to offer consistent value. Is the difference significant? No, a 1-tailed t-test on the two samples returned a p-value of 8%; that is to say, this difference could occur randomly 8% of the time. We need a p-value of 5% or lower before attempting to make a case for something more intentional.

Furthermore, when we consider that the average Pinnacle price appearing in the arbitrage, 4.74, is much longer than the average price of the other two options, 3.61, much of this difference can probably be explained by the favourite–longshot bias. Longer prices, by virtue of this bias, will attract proportionally greater margins.

Since 79% of the Pinnacle prices appearing in the arbitrage opportunities were draws or away wins, it’s then understandable why that average price will be longer than the other two. Finally, the reason disproportionately longer Pinnacle prices are appearing in the arbitrage opportunities in the first place is because their favourite–longshot bias is weaker than those of other bookmakers with bigger margins.

Perhaps statistical significance would come with a bigger sample of matches, but for the time being we cannot say that Pinnacle are deliberately exploiting the availability of arbitrage opportunities made possible by the loss-leading generosity of other bookmakers. Pinnacle, it would seem, just know what a price should be and generally stick to that pretty closely.

What happens by market closure?

One might expect that if bettors are using Pinnacle’s odds to exploit arbitrage opportunities, thereby applying a disproportionately bigger weight of money to that side of their market, Pinnacle would have to shorten those odds to protect their liabilities.

Pinnacle’s odds do shorten for this sample by market closure, but it’s barely noticeable, with an average price of 4.73, and no statistically significant difference between the two (p-value = 74% from a 2-tailed t-test), whilst the return to these closing prices, should anyone have bothered to bet them, would have been 95.0%. Returns from the other two prices still don’t offer the bettor any value on average, being 98.7%.

More proof of Pinnacle’s wisdom?

Over the past few years I’ve written numerous articles exploring the wisdom, efficiency or accuracy of Pinnacle’s soccer match betting market. Of course, I am rightly challenged about the conclusions I draw, most specifically that an efficiency on average does not necessarily imply efficiency on a specific match basis.

The reason disproportionately longer Pinnacle prices are appearing in the arbitrage opportunities in the first place is because their favourite–longshot bias is weaker than those of other bookmakers with bigger margins.

However, I will continue to insist that, on average, Pinnacle’s soccer match betting market is a very good representation of true outcome probabilities, once we have taken account of their margin and the way it is most likely applied by considering the favourite–longshot bias.

This analysis on arbitrage opportunities offers yet further evidence to support this view. Pinnacle make a point of offering accurate prices, or at least prices that do not stray away from ‘true’ values by more than their margin. Presumably, for them it’s the best pricing model with which to make a profit.

One thing we can be reasonably confident of is that unlike other more recreational bookmakers, Pinnacle are not in the habit of giving anything much away for free. If there are any systematic deviations away from market efficiency for the purposes of maximising their profit margin that might offer value to their sharper clients, they certainly don’t appear to be routinely evident amongst soccer arbitrage markets.

Of course, the upside to their accurate odds is that they will always allow you to practice arbitrage, knowing that it’s the other bookmakers, not themselves, that will be taking the hit.

MORE: TOP 100 Online Bookmakers >>>

MORE: TOP 20 Cryptocurrency Sportsbooks >>>

MORE: Best E-Sports Betting Sites >>>

Source: pinnacle.com