Betting exchanges offer bettors an alternative to the traditional bookmaker with the promise of better value, but how do they work and what are the hidden costs you should be aware of before deciding that they are the best deal for you? Read on to find out.

How do betting exchanges work?

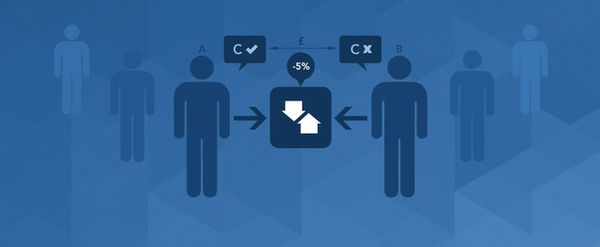

Betting Exchanges take a very different approach to traditional bookmakers - which pit themselves against the bettor. While bookies use well-informed traders to set the odds for each market, exchanges provide a platform for users to be both the bookmaker by offering their own odds (laying) or the bettor (backing) by accepting odds from another exchange user.

For example:

Effieciency vs. liquidity

Studies suggest that this peer-to-peer exchange model results in near perfectly efficient markets, as the implied probability of an event (how often we would expect a given event to occur) matches the odds offered, with a negligible variance.

The benefit of the exchange disappears when you include the commission charged on your winnings

This means that if you followed a consistent betting system with a 50% probability – such as a coin toss – you would be all square in the long-run. The potential for turning a profit arises from factoring in the advantage of handicapping skills or privileged knowledge.

This may be true for mature markets, however opening markets are often less efficient, as the number of bettors and level of liquidity (amounts available to bet) is too low to correctly balance the market. That means exchanges punish (or reward) extremely early bettors, depending on whether they are backing or laying.

The hidden costs of betting exchanges

| Stake £100 | Odds | Return before commission | Return after commission | Net Profit | ||||

|---|---|---|---|---|---|---|---|---|

| Team | Exchange (100.3%) | PS (102%) | Exchange | PS | Exchange (5%) | PS | Exchange | PS |

| Man Utd | 2.55 | 2.500 | £255 | £250 | £242 | £250 | £142 | £150 |

| Chelsea | 2.75 | 2.700 | £275 | £270 | £261 | £270 | £161 | £170 |

| Draw | 4.05 | 4.000 | £405 | £400 | £385 | £400 | £285 | £300 |

Irrespective of the issue of market efficiency, the benefit of the exchange disappears when you include the commission exchange’s charge on your winnings – up to 5%. Because this only affects your winnings, they aren’t factored into the odds, which make them appear better value than they actually are.

Assuming an average commission rate of 5%, your average bettor must now win at least 51.3% of their bets to achieve long-term profitability. That’s no competition for low commission bookmakers such as Pinnacle, which price many markets at just 2%, which translates to a 50.5% target for long term profitability.

MORE: TOP 100 Online Bookmakers >>>

MORE: TOP 20 Bookmakers that accept U.S. players >>>

MORE: TOP 20 Bookmakers that accept Cryptocurrency >>>

Source: pinnacle.com