Opportunity cost is a useful concept for deciding the best way to maximize return on investment from funds. Even profitable bettors should be aware of the potential costs of misallocating resources. Read on to find out more about applying opportunity cost to sports betting.

What is opportunity cost?

Imagine a high school student assessing the merits of attending University. What are the costs of studying the prospective student needs to consider? The initial cost of tuition is the obvious expense but it is not the only one the student must factor in.

In addition to the costs the prospective student incurs during their study, they must also consider the wages and experience they would have gained by working during this time instead. This is the opportunity cost to the student of higher education which needs to be weighed against the potential benefits of a university degree.

This is an important concept in investing. An individual who saves their money in a 1% interest savings account is technically a “profitable” investor given that they will have more money at the end of the year than they had at the start.

However, if inflation is at 3% then, in real terms, the investor has lost purchasing power. As the growth in the price of goods has been greater than the savers return on investment (ROI), they would have been better off purchasing their desired goods at the start of the year rather than saving.

Applying opportunity cost to sports betting

How does this concept affect sports bettors? To look at this we will follow four imaginary bettors, all of whom are profitable. In order to simplify this process several (unrealistic) assumptions have been made:

- The bettors have limited initial capital (€100)

- They are restricted to one action (no diversification of risk)

- They must stake the full amount on each bet (in a real scenario a staking methodwould be advisable)

- They are restricted to 100 bets annually

- Average ROI per bet: Bettor A : 01%, Bettor B: 1%, Bettor C: 2%, Bettor D: 4%

With all this taken into account this is what our bettors’ returns look like:

The return on investment indicates each bettor’s level of skill. Bettor A is marginally profitable whilst Bettor D achieves a high return on investment.

Opportunity cost in betting: Outrights vs singles

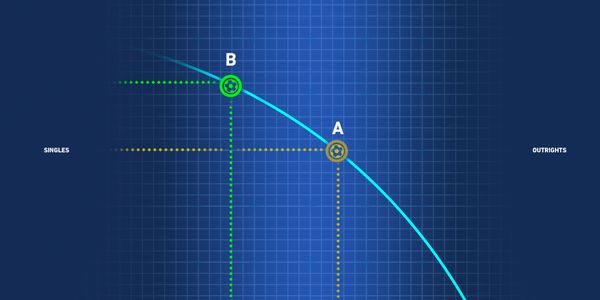

A common debate amongst bettors is whether tying up funds in long-term outright bets a good strategy or a misallocation of resources. This is essentially a debate about opportunity cost.

Assuming these skilled bettors have an edge on both outright and singles markets, what expected return on investment would be required to make a bet on a year-long bet on an outright market the optimal choice?

At a 100% expected return on investment, bettor A is better off by €89 but, even with such a big ROI, the other three bettors will lose out staking on the outright compared to allocating their initial funds to betting on the 100 singles.

For bettor D to eliminate the opportunity cost of betting on singles with that €100 over the course of the year (whilst the funds otherwise would be tied up in the outright stake) and make a significant profit they would need to stake on an outright bet with an expected return of investment of 5150%.

The higher skilled bettors must find an outright offering incredible value to overcome the compounding effect of staking that money on single bets.

Whilst this may offer an argument against staking on outrights, in this simulation our bettors have limited resources and do not need to account for variance. Real bettors could see outright betting as a good way to diversify risk. Certainly, not many bettors would turn down a bet with a 100% expected return on investment.

Sports betting vs the stock market

Hedge fund managers are assessed by how their returns compare to the general stock market. In simple terms, a hedge fund manager’s skill level is determined by how much their “expertly” selected portfolio can beat that of someone who simply purchases every major stock via an index fund.

Warren Buffett calculates stocks grow an average of 6 to 7% annually, so we will use the higher bound 7% growth rate as our average. How do our bettors fare when judged in the same way as hedge fund managers?

At average market growth all of the bettors return better than market profits, so there is no opportunity cost present. However, in a fast-rising market Bettor A makes a slight loss (opportunity cost of €3) whilst the other bettor’s real profits are significantly reduced.

In a falling market it would be possible for even a loss-making bettor to beat stock market returns, whilst the profitable bettors see a strong performance vs traditional stock investment.

In the long-run, all the bettors will be better off wagering on sports instead of investing but, in a one-off scenario, bettor A could incur an opportunity cost during a fast-rising market.

The opportunity cost of betting at inferior odds

As has been demonstrated above, even profitable bets can have opportunity costs. This is especially true if a bettor is not taking the best odds available.

*For the calculations behind these figures please see the bottom of this article

If the initial ROI of each bettor was with them betting at Pinnacle’s margins (2% in this case) then taking the industry average (6%) will obviously lead to lower profits.

This is the opportunity cost of taking inferior odds, a cost that becomes an increasingly important factor as the bettor becomes more profitable. Bettor D would incur an opportunity cost of €191 by choosing to bet at the industry average rather than with Pinnacle.

Taking inferior odds can also be loss-making. A hypothetical bettor with an expected return on investment of 2% (€102 return) over the course of the 100 bets at the two percent margin would return only €98 at the six percent level.

In the real world, a bettor profitable to the extent of bettors C and D is likely to place more wagers at higher stakes than simulated here. The effect of taking inferior odds on returns would be even more pronounced in this case.

What should bettors learn from opportunity costs?

Of course, skilled bettors are well aware of the importance of taking optimal odds as well as not tying up funds in long-term positions that could be better used elsewhere. However, they are important concepts worth remembering.

Perhaps of most use to bettors is the comparison with the stock market. If Warren Buffett is correct (and history suggests he is), then bettors need to beat stock market returns of 6-7% to ensure they are not incurring an opportunity cost compared to merely investing in an index fund.

In reality, profitable bettors are likely to find enough value bets to ensure they outperform the stock market. Another big advantage of sports betting is that there is no such thing as a falling market, so there will not be an overnight plunge in bettor’s funds (as long as a proper betting strategy is followed), nor should irrational actors affect the bettor’s ability to increase his bankroll.

*Opportunity cost of inferior odds calculations from Pinnacle Business Intelligence Analyst Joel Johnson

To give a breakdown of the calculations used for the above examples, we can use the simple idea of betting on coin flips – specifically in this instance the case where a bettor earns an 11% return on investment on €100 worth of bets.

If Pinnacle were to offer prices on coin flips with their 2% margin applied this would result in a price of 1.961 for both heads and tails. On the other hand, with an industry standard margin of 6% this implies a price of 1.887 (see ‘How to calculate betting margins’ to learn how these were calculated).

In order to achieve an 11% ROI after 100 bets on coin flips (at Pinnacle’s odds), this requires the customer to correctly predict;

€111/1.961 ≈ 57 (1)

out of 100 coin flips.

Although, winning these same 57 coin flip bets at an industry standard margin betting company, this results in;

€1 x 57 x 1.887 ≈ €107 (2)

Hence meaning €4 less for the customer despite achieving the same amount of winning bets.

MORE: TOP 100 Online Bookmakers >>>

MORE: TOP 20 Bookmakers that accept U.S. players >>>

MORE: TOP 20 Bookmakers that accept Cryptocurrency >>>

Source: pinnacle.com