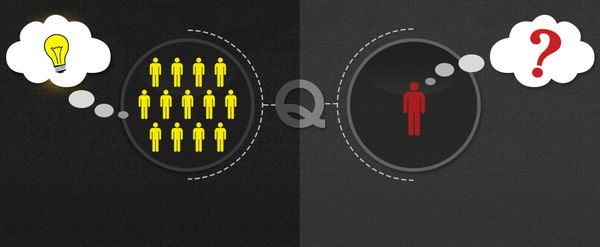

If you have a difficult conundrum, it’s reasonable to assume that the more people you survey, the better your solution will be. This theory is known as the ‘wisdom of the crowds’, and is an effective way of making decisions under uncertainty, like estimating the probability or outcome of a sports betting prediction.

The trouble is that sometimes the crowd acts like a foolish herd – so how do you know when the collective is getting things wrong?

How wisdom of the crowds works

The wisdom of the crowds works by averaging estimates from a wide variety of people. Participants will equally over- and under-estimate outcomes, leaving the average of their predictions as close to perfect.

Guessing the number of sweets in a large jar is a favourite game at fairs and fetes, and provides a simple illustration of the power of collective wisdom. The most effective way to predict the number of items is to wait until close to the contest deadline, and then simply average all the guesses.

By doing this you are benefiting from the estimates of all the pairs of eyes that have perused that jar. It may a be a little impractical and you will certainly draw a few strange looks as you perch your calculator on the trestle table, but it illustrates how to harness collective wisdom. And could win you a few sweets, too.

Predicting the unknown – the USS Scorpion

The wisdom of the crowds phenomenon was first observed in the early 20th century by the eminent anthropologist, Sir Francis Galton. When at a livestock fair he observed a competition to guess the weight of a butchered ox. No one-person got the correct weight but Galton calculated the median of guesses as being within 0.8% of the answer, stating that “the middlemost estimate expresses the vox populi, every other estimate being condemned as too low or too high by a majority of the voters.”

The vox populi or Wisdom of the Crowds transcends many aspects of decision-making, a wide and fascinating cross-section of which are examined by James Surowiecki in his 2004 book on the subject. Among its fascinating anecdotes is the story of search for the USS Scorpion submarine, which was lost in the North Atlantic in May 1968.

In its search efforts, the navy was only able to locate the wreck to within a 20-mile range. In a test of collective wisdom, naval officer – Dr. John Craven – gained individual insights from a wide and varied group of naval/salvage experts, and used their collective information to pinpoint a location that turned out to be just 220yds from the wreck of the Scorpion.

So how did these individuals’ unrelated opinions average-out to such accuracy?

How this can influence a sports betting prediction

Just like locating a shipwreck, the results of sporting events cannot be known a priori, yet even under these conditions the crowd does generally provide an accurate assessment of the respective probabilities of the outcomes.

Odds gain accuracy from the wisdom of the crowds by shaping a bookmaker’s opening line and exposing it to public appraisal.

Very sharp bettors will have their own ideas about opening lines that, when they diverge with the bookmakers, will cause the sharp bettors to bet quickly and re-shape the markets. This happens a lot at Pinnacle because we have the sharpest players – high precision individuals – attracted by the lowest margins.

As markets become more liquid – i.e. more people voice their sports betting prediction by placing bets – the market generally moves to its most efficient position, just as the more guesses of the number of sweets, the more accurate the average guess.

However, in the Scorpion story, Craven restricted his ‘crowd’ to the best available experts, and garnered opinions independently, but in betting high precision individuals aren’t the only participants, and decisions aren’t made in a vacuum, so what happens when other less sophisticated bettors weigh in, and when there is a total absence of sharps?

Behavioural biases & information cascades

The bettors that contribute to the movement of a market are generally drawn from a wide spectrum of knowledge and experience, and there is often a specific distribution to the times that different groups place their bets.

One of the recurring themes in our articles is the importance of understanding behavioural biases, and how they can impede rational risk assessment. As already mentioned, sharp players tend to act soonest, while public money – effectively less informed betting – tends to happen closest to event start times, and frequently reflects very general rules of thumb, e.g. “which team am I more familiar with?”, “which team do I recall winning more often?”, “which team is everyone else betting on?”

These lazier judgments normally result in more money on the favourite, skewing the market away from its most efficient position. This is an illustration of how the wisdom of the crowds can be replaced by the foolishness of the herd.

Public money may distort rather than reverse a market, but this kind of collectively poor reasoning – known as an information cascade – can have far greater impact.

Wooden roads & Harry Redknapp

Examples of information cascades outside of betting include a run on the bank, or the rise and swift fall of wooden roads in the 19th century (if you are intrigued by this, read Surowiecki). In the betting world, the managerial markets often follow the information cascade model, with the events following Fabio Capello’s resignation as England manager on February 8th 2012 a salient example. Bettors were willing to wager huge amounts at very skinny odds that Harry Redknapp would replace Capello as the England manager.

Although technically still a sports betting prediction, in this situation, precision individuals were absent. The market was driven to an inaccurate judgment based on persuasive arguments for Redknapp’s appointment (there was momentum behind an English manager, Redknapp had enjoyed a successful spell with Spurs and the public was seemingly behind his appointment), while many bettors were willing to rely on the judgment of others (and the media). Not being privy to the information of others bettors assumed that the information amounted to more than just speculation or wishful thinking. It didn’t – Roy Hodgson was announced as the new England manager on 1st May 2012.

In an information cascade, decisions are made sequentially, generating momentum, as the effect of incremental decisions being based on the existing opinion that helped build the feedback loop that drove the price down.

The information cascade phenomenon underlines the point from the Scorpion anecdote – the harder the question, and/or the weaker the knowledge pool the less reliable the collective wisdom. If bettors can avoid being swept away by the cascade, these situations can present significant opportunities and help inform a sports betting prediction.

Pump and dump – market manipulation

Motivation is a key factor in forming and movement of markets. Speculators are motivated by profit but the ways in which this can be achieved are divergent. In the financial world Pump & Dump commonly refers to the practice of hyping shares to inflate their price and enable short-term gains, while the inverse is also common with shortening of shares that are driven down by negative speculation. These tactics drive the market in an unnatural direction, and equally apply within betting. The speed with which information now disseminates (via social media) can make this even more pertinent, and is not a circumstance where the crowd can be trusted.

Niche markets

Notwithstanding some of the biases we have outlined, the more liquid a market, the better the collective wisdom. This applies to major sports – big soccer leagues, US major league sports and tennis grand slams – which make it much harder for bettors to find value. Niche sports however, can provide opportunities because of the absence of information, and therefore wisdom.

There will be far fewer high precision individuals betting niche markets, and it will also test the knowledge of the bookmaker, which presents opportunities for those bettors prepared to do the research, and who are able to recognise when the crowd is lacking wisdom and react accordingly.

MORE: TOP 100 Online Bookmakers >>>

MORE: TOP 20 Bookmakers that accept U.S. players >>>

MORE: TOP 20 Bookmakers that accept Cryptocurrency >>>

Source: pinnacle.com