People often say that nothing in life is free. However, plenty of bookmakers will offer customers a “free” bet. Whether these free bets are actually free is up for debate, but bettors will still want to know how to get the best value out of these offers. Read on to find out how to get the most out of a free bet.

In a previous article for Pinnacle, Benjamin Cronin explained how and why free bets and other promotional offers are simply a marketing ploy used by bookmakers to acquire clients and rarely offer any value.

While the headline offers often seem attractive, a consideration of the maths and terms and conditions usually reveals otherwise. Nevertheless, understanding the value that these promotions actually contain is a good starting point when deciding if and how to use them.

What to do when a bet is actually free

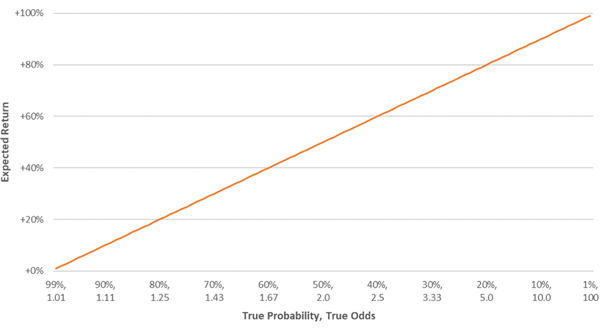

First, consider a simple free bet with no terms and conditions. Any winnings from the free bet can be withdrawn in cash, with no turnover requirements. What is the optimal strategy? Assuming odds reflect the true probability (odds with no margin), the chart below plots the expected return to a bettor from a bet at different odds.

We can see that expected return to the bettor increases with the odds. For example, if you have a $100 free bet and bet at odds of 2.0, 50% of the time you will lose and 50% of the time you will win $100, so your expected return is $50, or 50%. If you bet at odds of 5.0, 80% of the time you will lose and 20% of the time you will win $400, so your expected return is $80, or 80%.

The tendency to be attracted to lower odds on a free bet could be considered consistent with the findings of Kahneman and Tversky’s in their 1979 paper on Prospect Theory.

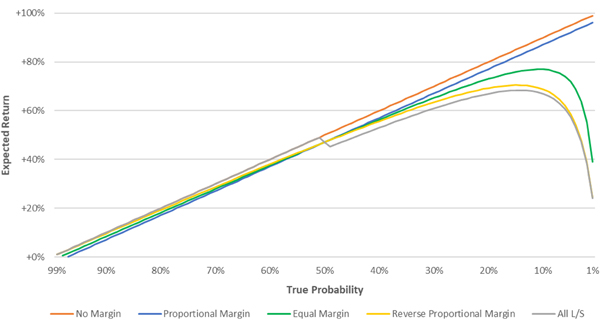

While this is an interesting result in itself, we know that bookmakers will add a margin to their odds. However, we won’t know exactly how they apportion the margin on every event. Let’s consider what the bettor’s expected return looks like with different margin distributions.

The chart below plots expected returns with four methods for apportioning a 3% margin in a two-way market: equal (1.5% each side), proportional (for example, 70% of the margin for 70% true probability), reverse proportional (for example, 30% of the margin for 70% true probability), and all margin in the longshot (3% in the longshot).

If the margin is apportioned proportionally, the expected return increases with the odds. From an expected return perspective at least, the optimal strategy is to bet at the highest odds possible.

If the margin is apportioned proportionally, the expected return increases with the odds. From an expected return perspective at least, the optimal strategy is to bet at the highest odds possible.

If the distribution sees more (than proportional) margin in the longshot’s odds, the expected return will decrease at a certain point as odds increase. This can be seen in the plots of expected return with equal and reverse proportional distribution, and with all the margin in the longshot. In the extreme case where the entire margin is in the longshot’s odds, it is still optimal to increase your free bet odds up to 5.88. This will maximise your expected return at 68%.

Understanding turnover requirements

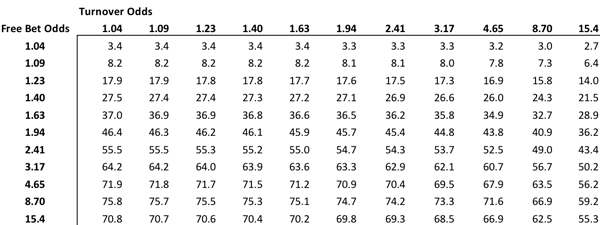

The most common way bookmakers decrease the value of free bets is with a requirement to satisfy a particular level of turnover with any free bet winnings. Consider a $100 free bet where you are required to turnover your winnings once before you are able to withdraw the funds. This means that if you win $90 from this free bet, you need to wager this $90 before you can withdraw any remaining funds.

From above we know that the optimal strategy for the free bet is generally to increase the odds taken. But what about the subsequent ‘turnover’ of winnings? If we focus only on maximising expected return, then betting on odds that are as close as possible to fair is optimal. For odds containing a favourite longshot bias this would mean betting on short odds.

The table below shows the expected value of a $100 free bet, for different combinations of odds taken with the free bet and odds taken for the subsequent turnover of winnings. Assuming the odds contain an equally distributed 3% margin, the maximum expected value of a $100 free bet is $75.80.

Bookmakers often have additional conditions, such as turnover must be at odds of 1.50 or higher, or free bet winnings must be turned over twice, or three times. The more conditions that are attached to a free bet, the less it’s worth.

What about variance?

Maximising the expected value of a free bet will no doubt mean higher variance. For example, maximising the value of a $100 free bet in the example above would require the free bet to be placed at odds of 8.0. The true probability at these odds is 11%.

This means that 89% of free bets will return nothing, and $700 profit will be generated 11% of the time. While it may be tempting to adopt a regret aversion mindset and focus on the idea of generating even some profit from a free bet, (for example, by betting at lower odds) given their one-off nature, I suggest concentrating on expected return.

Prospect theory and free bets

The tendency to be attracted to lower odds on a free bet could be considered consistent with the findings of Kahneman and Tversky’s in their 1979 paper on Prospect Theory. They show that people tend to be risk-averse in choices involving gains. For example, in selecting between a certain $3,000 payoff or a $4,000 payoff with an 80% probability ($3,200 expected value), the vast majority of respondents chose the certain $3,000.

The most common way bookmakers decrease the value of free bets is with a requirement to satisfy a particular level of turnover with any free bet winnings.

Given a free bet has only potential for gain, it seems likely that bettors may mirror this risk aversion and seek out more certain (lower odds) bets. If this sounds like you, you may be interested to know that you’re probably demonstrating the overweighting of certainty principle.

On the flip side, the reflection effect explains that in the negative domain (where losses are possible) people become risk-seeking. When presented with a choice between a certain loss of $3,000 or a loss of $4,000 with a probability of 80% (-$3,200 expected value), an even larger majority chose the gamble, despite it having a lower expected value.

Kahneman and Tversky also found that because people are poor at comprehending events with extremely low probabilities, these events are generally thought to occur more frequently than they actually do. Considered together, these two findings appear to provide a good explanation for the favourite-longshot bias. Kahneman and Tversky actually suggested that they contribute to the attractiveness of gambling itself.

What have we learnt about free bets?

Free bets are a tool used by bookmakers to attract customers and get you to bet, usually into odds with high margins. Unfortunately, understanding and implementing an optimal strategy for their use may prove a step towards being banned or limited, which is how most bookmakers deal with knowledgeable clients. Pinnacle, on the other hand, focuses on offering the best value odds, highest margins and a unique policy of welcoming winners.

MORE: TOP 100 Online Bookmakers >>>

MORE: TOP 20 Bookmakers that accept U.S. players >>>

MORE: TOP 20 Bookmakers that accept Cryptocurrency >>>

Source: pinnacle.com